Last Updated: 26th November 2022

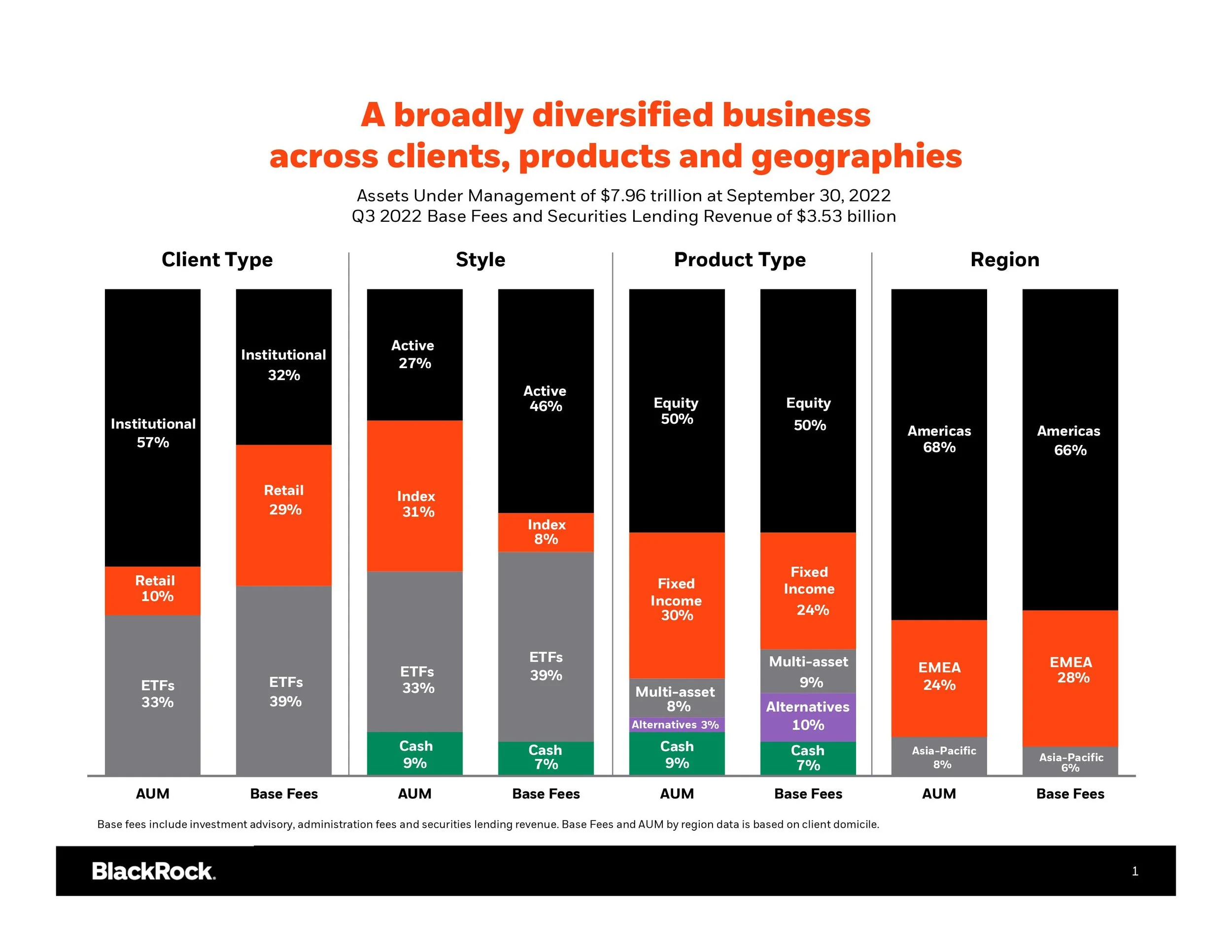

Blackrock is an investment management firm with over $10 trillion of assets under management. They serve individuals and families, companies and governments with a range of investment products, supported by their investment technology platform - Aladdin.

Employees: 18,400

Revenue: $19bn for FY2021

HQ Location: New York, US

What they do:

Investment products across a range of assets including equities (stocks), fixed income (bonds), alternatives and money market instruments.

Products are offered directly and via intermediaries including mutual funds and Exchange Traded Funds (ETFs).

They provide technology platforms including Aladdin, Aladdin Wealth, eFront and Cachematrix.

Their vision and priorities:

Management seeks to deliver value to shareholders over time by:

Focus on strong performance providing alpha for active products and limited or no tracking error for index products

Global reach with 50% of employees outside of the US

Breadth of product offerings

Differentiated client relationships to allow them to lead customers

A long standing commitment to innovation, technology services and development of technology products including Aladdin.

Three things to know right now

Martin Small to Succeed Gary Shedlin as BlackRock CFO in 2023

Martin Small has been running the US Wealth Advisory business for the last four years and will take on the company’s CFO duties in March next year.

“Martin has had a truly ‘One BlackRock’ career at the firm, working across a diverse mix of teams that give him a broad and deep knowledge of the firm and our people”

The Aladdin platform is strategic

Aladdin is an investment technology platform and a key strategic initiative for the company.

Aladdin allows teams across investments, trading, operations, administration, risk, compliance, and corporate oversight to use a consistent process and share the same data.

One Blackrock

“We work without silos and without turf to create the best outcomes for our clients, our firm, and the communities where we operate.”

A diverse workforce is how we answer the biggest questions, and a inclusive, equitable environment makes us thrive.

Aladdin unifies us, creating a common language for us to interpret the world, the markets, and our clients’ needs.

What does each business unit do?

Retail

Their retail division holds approximately 10% of the assets under management, providing individuals and families with investment products across equities, fixed income, multi-asset and alternative investment products.

Institutional

This business unit represents approximately 50% of the assets under management, providing investment products to pension funds, corporations and governments.

Blackrock is one of the largest managers of pension funds with $3.2 trillion under management.

ETF

An Exchange Traded Fund (ETF) is a collection of assets that can be traded on the stock market like any normal stock.

The constituents of the ETF can be actively selected (an ETF focused on technology companies), or they can be index linked (an ETF that tracks the S&P 500)

Blackrock is the largest ETF provider in the world with $3.3 trillion under management.

Their financial calendar

Q1: January-March - Earnings 13th April

Q2: April-June - Earnings 13th July

Q3: July-September - Earnings 13th October

Q4: September-December - Earnings 13th January

Positives from the last earnings report:

$65bn of net inflows driven by momentum in ETFs (Exchange Traded Funds)

6% increase in technology services revenue year-over-year reflecting strong demand for Alladin.

$375 million of share repurchases in quarter

Challenges from the last earnings report:

15% decrease in revenue year-over-year primarily driven by the impact of lower markets and dollar appreciation.

21% decrease in operating income

15% decrease in diluted Earnings Per Share (EPS)

Next Earnings Report:

Around 13th January 2023

Something to add?

If you have new information that would help others, drop us a note through this form and we’ll verify prior to updating this page.

Thanks for helping,