Last Updated: 1st December 2022

Rolls-Royce is a global aerospace manufacturer. They are NOT to be confused with the luxury car maker of the same name and with the same logo! The two companies were separated in 1973 and are run completely independently.

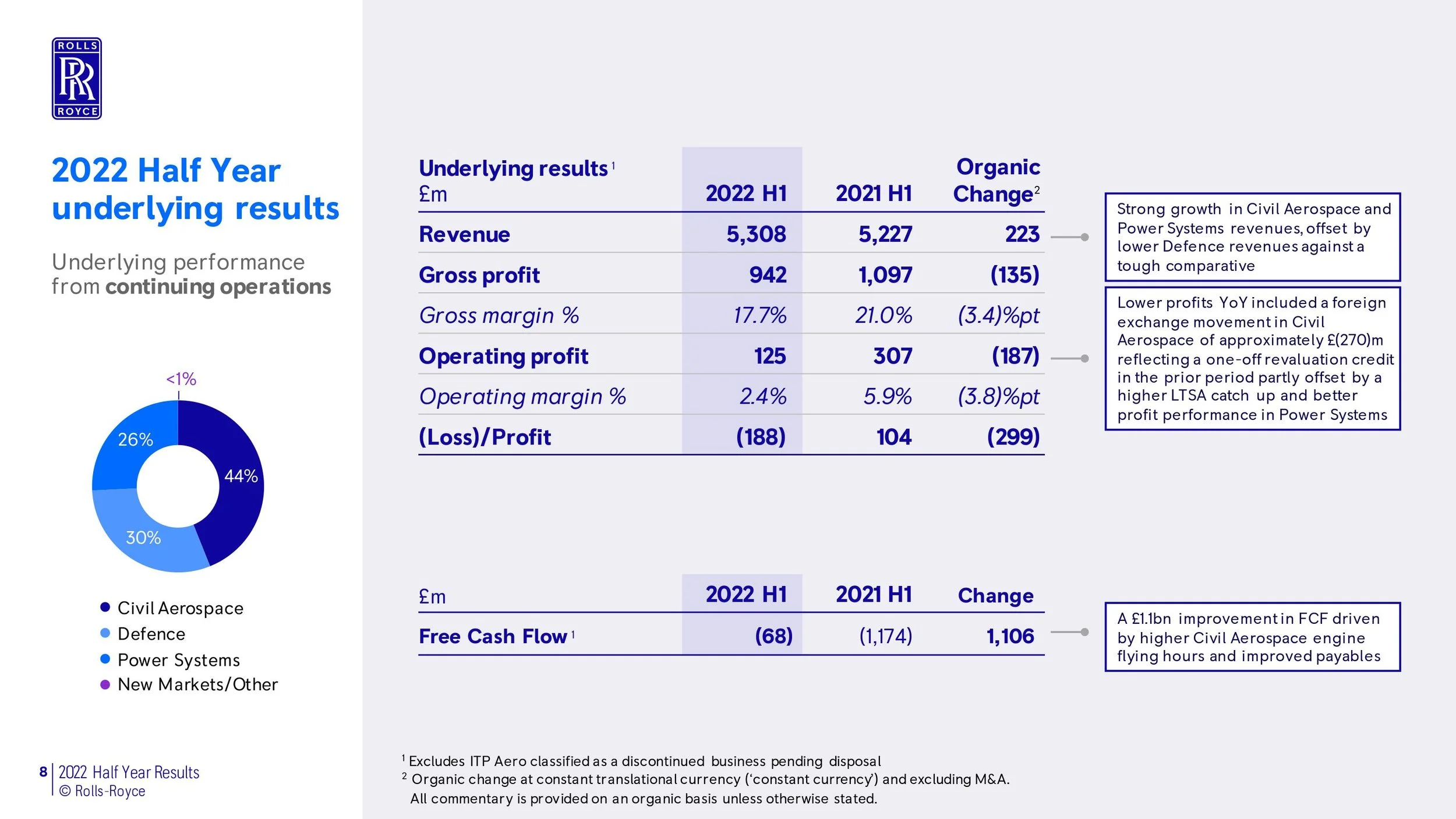

Rolls-Royce sought emergency funding during COVID as air travel came to a halt, and their priority today is to return to profitable and sustainable growth.

Employees: 44,000

Revenue: £11bn for FY2021

HQ Location: Derby, United Kingdom

What they do:

Manufacturer of engines for aeroplanes

Civil Aerospace - engines for commercial airlines, regional jets and business use. This division has 11,800 engines in use around the world, two thirds of which are covered by a long term service agreement.

Defence - engines for military use with 150 customers and 16,000 engines in use across aeroplanes and combat and transport helicopters. Rolls-Royce was chosen in 2021 to power the fleet of 76 US B-52s.

Power Systems - provide large gas or diesel fuelled engines and power systems for factories, industrial usage, or marine environments. See their subsidiary mtu Solutions. Power Systems has 20,000 engines in use and accounts for 18.5% of the employee base.

New Markets and Other Businesses - this division holds anything that doesn’t fit above but accounts for only 3% of revenues.

Their vision and priorities:

Delivering on our commitments: In 2020 during the height of the COVID pandemic Rolls-Royce needed to seek emergency funding as their order book dried up. As part of securing that funding they made certain commitments, “We have completed our restructuring, assisting us in meeting our pledge to turn cash flow positive during the second half of 2021. We have also announced a series of agreements as a result of our programme to raise around £2bn from disposals.”

Maximise value from our existing investments: The company has decades of investment in their technology and a key strategy is to leverage that, helping customers to use their engines for longer, and helping drive towards net zero.

Seizing opportunities for growth: The company is focused on opportunities were they can accelerate their growth, especially in newer fuels and the drive for sustainability and net zero.

“As a result of the actions we have taken over the last few years, our Civil Aerospace business is becoming leaner and more agile, and we are executing on the levers of value creation we shared at our investor event in May. This is setting us up to deliver on our commitments this year and in the future. We are making choices to manage the current challenges, deliver better returns, reduce debt, and generate long-term sustainable value.” Warren East, CEO

Three things to know right now

Business recovery underway

The company is focused on cost control and returning to sustainable and profitable growth.

Any investments will be directly linked to either increasing the order book, or saving costs elsewhere.

Transition to net zero

Rolls-Royce’s core products are heavy carbon users. The airline industry is a significant contributor to greenhouse gas emmissions, and the company has a core strategy to reinvent itself as a zero carbon business.

Divestment of ITP Aero

In September 2022 Rolls-Royce completed the divestment of their Spanish subsidiary ITP Aero raising €1.8bn to support the balance sheet.

More details here.

Subsidiaries

A full list of subsidiaries can be found on pages 190-194 on the annual report.

Competitors

Rolls-Royce’s main competitors include General Electric (GE), Bombardier, Pratt and Whitney, and Honeywell

Their financial calendar

H1: January-June - Earnings 4th August

H2: July-December - Earnings Late February

Positives from the last earnings report:

Good progress on order intake - record orders for Power Systems

£1.1bn in free cash flow improvement (money coming into the business) from cost saving measures and increased flying hours post COVID. This quarter the company had £597m of cash coming in, versus £679m of cash going out last quarter - so a £1.1bn improvement

Challenges from the last earnings report:

Underlying profit margins were lower in first half, but expected to improve in second half.

Controlling costs and using contractual and pricing discipline to limit inflation effects.

Next Earnings Report:

Around End of February 2023

Something to add?

If you have new information that would help others, drop us a note through this form and we’ll verify prior to updating this page.

Thanks for helping,